Identity theft is a serious crime that can cause significant financial and emotional distress. With the rise of digital transactions and the increasing amount of personal information stored online, protecting yourself from identity theft is more important than ever.

Fortunately, there are steps you can take to safeguard your personal data, both offline and online. At CCS Cork, we are committed to helping you maintain your privacy and security by offering expert document shredding services, ensuring that sensitive information does not fall into the wrong hands.

1. Shred Personal Documents

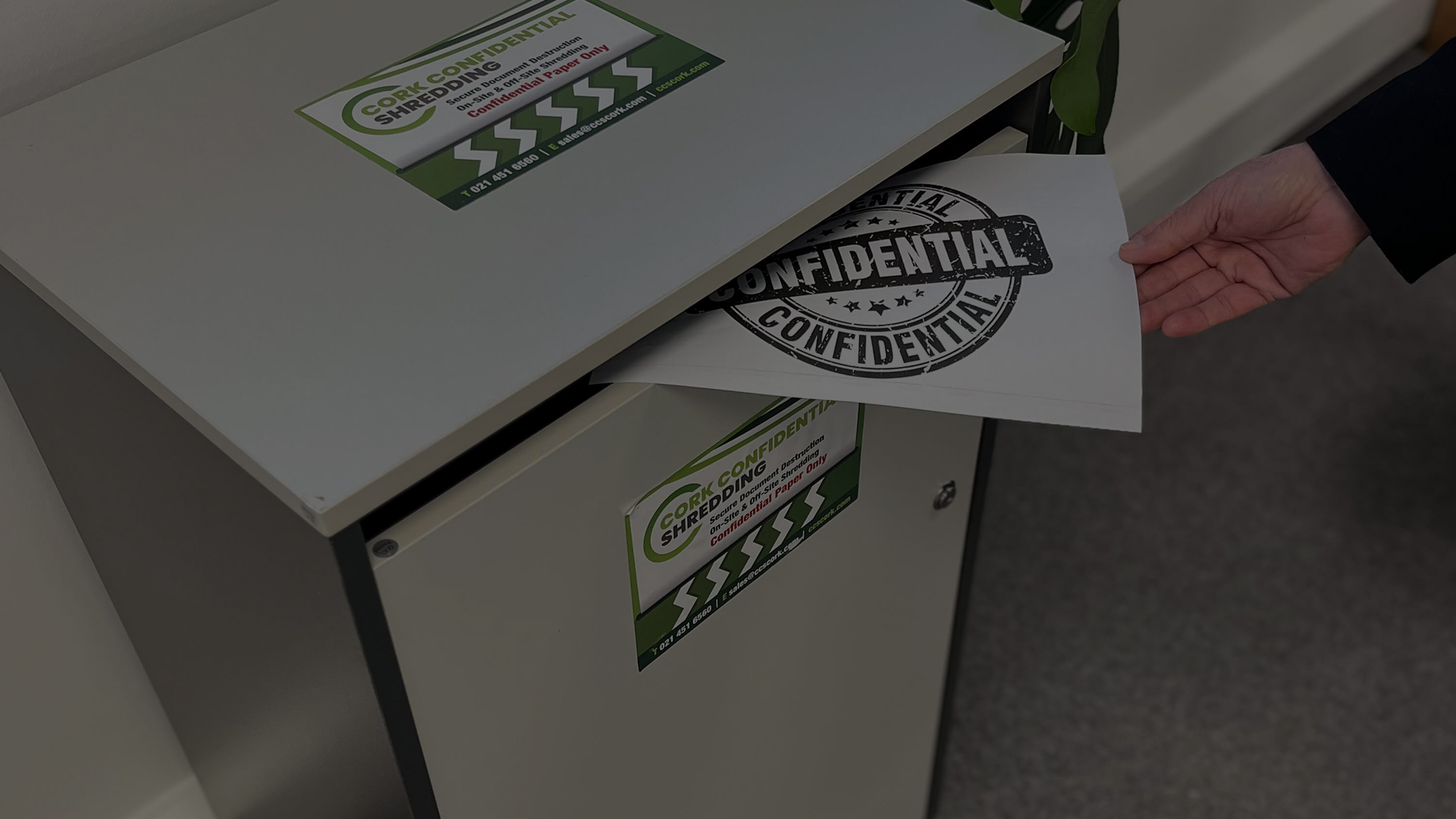

One of the most effective ways to prevent identity theft is by securely disposing of sensitive documents. Old bank statements, tax returns, medical records, and even credit card offers can contain personal information that criminals can use to steal your identity. Shredding your documents is the first step toward protecting yourself.

At CCS Cork, we offer professional shredding services that ensure your documents are securely destroyed. Our on-site shredding services provide an added layer of security by destroying sensitive materials right at your location. By shredding your documents, you minimize the risk of personal data theft.

2. Be Mindful of What You Share Online

With the advent of social media and other online platforms, it’s easier than ever to share personal information. However, oversharing can leave you vulnerable to identity theft. Cybercriminals use social media to gather personal details, such as your full name, birthdate, address, and even the names of your family members.

Limit the amount of personal information you post online and adjust your privacy settings on social media accounts to control who can see your data. Avoid posting sensitive information like your address or full date of birth, and think twice before sharing travel plans or updates that may signal when you’re away from home.

3. Monitor Your Financial Accounts Regularly

Keeping an eye on your financial accounts is crucial to spotting any unusual activity that could indicate identity theft. Set up alerts on your bank accounts and credit cards to be notified of any transactions, especially large ones or those you don’t recognize. Regularly check your account statements to ensure no unauthorized transactions have occurred.

Consider subscribing to identity theft monitoring services that alert you to any suspicious activity related to your personal information. These services can help you catch identity theft early, allowing you to take action before significant damage is done.

4. Use Strong, Unique Passwords

A major vulnerability for identity theft is weak or reused passwords. Using easy-to-guess passwords, like your pet’s name or your birthdate, makes it easier for hackers to access your personal accounts. A strong password should include a mix of letters, numbers, and special characters, and it should be unique for each account you have.

Consider using a password manager to store your passwords securely and generate strong, unique passwords for every account. This will significantly reduce your chances of falling victim to account takeovers, which are often used to steal identities.

5. Be Cautious with Public Wi-Fi

Public Wi-Fi networks, such as those found in coffee shops or airports, are often not secure, making them prime targets for cybercriminals to intercept sensitive data. Avoid accessing sensitive accounts or making online purchases while connected to public Wi-Fi. If you must use a public network, consider using a virtual private network (VPN) to encrypt your data and protect it from prying eyes.

6. Shred Your Mail

Identity theft isn’t limited to what’s stored on your computer. Criminals can also target physical mail. Look out for bills, credit card statements, or any correspondence that contains personal information. Shredding your mail before discarding it is a smart practice to prevent thieves from getting access to your private data.

You can even use a mailbox with a locking feature to prevent thieves from accessing your mail before you do. The more you can limit your exposure to potential threats, the better.

7. Report Suspicious Activity Immediately

If you suspect that you’ve become a victim of identity theft, take action quickly. Contact your bank or credit card company to report any fraudulent charges and freeze your accounts if necessary. You should also alert the Credit Bureau and place a fraud alert on your credit report to prevent further damage.

The sooner you take action, the easier it will be to minimize the effects of identity theft.

8. Stay Informed

Identity theft tactics are constantly evolving, so it’s important to stay informed about the latest trends and methods used by criminals. Regularly read up on cybersecurity practices and learn about new scams that may be targeting your personal information. Knowledge is one of your best tools in preventing identity theft.

Protect Your Personal Information with CCS Cork

Identity theft can have long-lasting effects, but with the right precautions, you can safeguard your personal information. At CCS Cork, we make it easy to securely dispose of your sensitive documents through our professional shredding services. Contact us today to learn more about how we can help protect you from identity theft and keep your personal data safe.